Accounts Receivable Experts

Accounting Tools

Industries Served

Cash Forecasting Accuracy

Outsource Accounts Receivable services to VE to get a comprehensive range of Accounts Receivable services for businesses in the real estate industry. These include tenant AR management, handling month-end accounting tasks, and real estate AR reporting services, among others.

Accounts Receivable is a rigorous and resource-intensive activity that includes everything from tracking the order chain to recouping lost money. Outsourcing AR management allows you to create a well-designed system for creating, mailing, and following up with client invoices.

Hire AR professionals from Virtual Employee who are adept at identifying your Accounts Receivable needs, setting up your Accounts Receivable process, selecting the right Accounts Receivable software, monitoring and managing your AR process, and finally evaluating its success.

Recruit an Accounts Receivable expert from VE who will gather the necessary documents, verify your AR ledger, reconcile the Accounts Receivable ledger with the sales invoices and customer payments, adjust the Accounts Receivable ledger, as well as review and store the reconciliations.

Kick-start your project straightaway with our popular No-Obligation, No-Payment, 1-Week Free Trial. Continue with the same resource if satisfied.

Our free, quick, bespoke hiring process helps you save on not just expensive local recruitment fees but also lengthy waiting periods to hire just one resource.

Get your own 'remote workplace in India’, do away with pesky issues such as HR, Admin, Payroll, etc. and only pay your offshore Accounts Receivable expert’s salary.

As an ISO 27001:2013 certified and CMMiL3 assessed company, VE assures its clients of breach-proof data security and confidentiality at all times.

A QuickBooks-certified bookkeeping pro who thrives in high-volume, high-velocity environments. Expert in tax categorization, platform integrations, and reconciliation workflows built for fast-moving service-driven businesses.

A seasoned bookkeeper who owns your closings from day one. Skilled in budgeting, forecasting, and multi-ledger reconciliation, with a track record of delivering clean, audit-ready books for SME clients using QuickBooks and Zoho.

A US GAAP-aligned bookkeeper with expertise in AR/AP cycles, financial statements, and general ledger integrity. Navigates cloud platforms, remote payroll, and multi-currency workflows with precision.

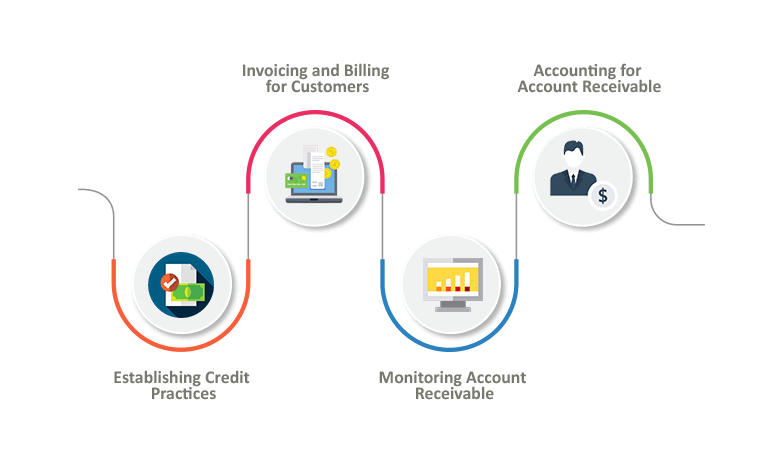

A credit application is first developed to outline the terms and conditions of credit sales. This helps prevent future credit risks.

An invoice is created that entails listing the cost and details of the product or service rendered, as well as the date by which it should be paid.

An AR expert will monitor the payment deposited in the supplier’s bank account, record it in the system, and allocate it to an invoice.

The offshore Accounts Receivable expert from India establishes the due date for both bad and unpaid debts.

It has made me possible to live the kind of life I wanted. I can travel & run my business.

Within a month of starting, he had my QuickBooks all caught up and in a much better state.

He is a very good example of how outsourcing AR and AP can actually work.

No card details required.

Senior technical architect's assistance.

Keep all the work. It's yours.

Businesses have been preferring to outsource finance and general accounting right from the onset of outsourcing, and this practice...

Read More >

What is one of the most important factors that contributes to the slow-paced growth of an organization...

Read More >