CPA-Certified Accountants

Invoices Processed

Accounting Tools Mastered

Cost Reduction

Get reliable and error-free processing of your monthly AP ledgers to remain on track with all payments done every month. Gain visibility into all the current and outstanding accounts payable.

Hire AP specialists to ensure simplified utility bill gathering, validation and payment for delivering process efficiencies and added transparency to the facility and accounts payable teams.

Outsource accounts payable to compile vendor master data which includes procurement history, contract records, etc. for creating a single source of truth for data linked to specific vendors.

Our AP specialists examine the vendor statements and invoices to recognize and validate any cost recovery options, find the primary causes of variations, settle and make financial recoveries.

A seasoned bookkeeper who owns your closings from day one. Skilled in budgeting, forecasting, and multi-ledger reconciliation, with a track record of delivering clean, audit-ready books for SME clients using QuickBooks and Zoho.

A US GAAP-aligned bookkeeper with expertise in AR/AP cycles, financial statements, and general ledger integrity. Navigates cloud platforms, remote payroll, and multi-currency workflows with precision.

A QuickBooks-certified bookkeeping pro who thrives in high-volume, high-velocity environments. Expert in tax categorization, platform integrations, and reconciliation workflows built for fast-moving service-driven businesses.

Kick-start your project straightaway with our popular No-Obligation, No-Payment, 1-Week Free Trial. Continue with the same resource if satisfied.

Our free, quick, bespoke hiring process helps you save on not just expensive local recruitment fees but also lengthy waiting periods to hire just one resource.

Get your own 'remote workplace in India’, do away with pesky issues such as HR, Admin, Payroll, etc., and only pay your remote accounts payable specialist’s salary.

As an ISO27001:2013 certified and CMMiL3 assessed company, VE assures its clients of breach-proof data security and confidentiality at all times.

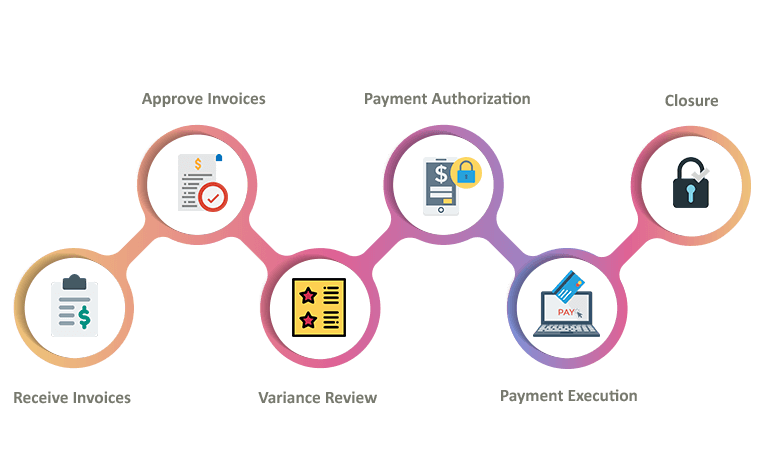

Your accounts payable specialists receive the vendor’s digital invoices and perform a three-way match to verify the purchase order, goods receipt and invoice.

Next, VE’s virtual accounts payable experts review and approve supplier invoices after verification of receipts. This takes place before the invoices are recorded as a cost within the ERP and sending the payments.

Our AP specialists from India then closely check and flag any inconsistency in quantity or price during invoice processing to the company and the vendor.

After all the variances are checked and addressed, the invoice is vouched for and authorized by the concerned authority.

Once everything is cross-checked and verified, payment is issued promptly, and remittance details are sent to the vendor.

Once payment is made, the invoice is marked as paid, closed out of the system, and filed into various repositories.

It has made me possible to live the kind of life I wanted. I can travel & run my business.

Within a month of starting, he had my QuickBooks all caught up and in a much better state.

She's worked hard and battled through family commitments to deliver the work we needed.

No card details required.

Senior technical architect's assistance.

Keep all the work. It's yours.

What is one of the most important factors that contributes to the slow-paced growth of an organization...

Read More >

The tedious, monotonously draining nature of accounting work can take its toll on you and lead to oversight or miscalculations...

Read More >

These days, there is a new trend emerging in the offshoring industry in India. Bookkeeping services in India...

Read More >