Certified Financial Controllers

Apt Business Forecasting

Accounting Tools Mastered

Years’ Combined Experience

Hire remote financial controllers from India who can effectively track and secure the assets of your company. The fixed assets would be managed through tags bearing a serial number and the bar codes on the assets will be maintained through trackers.

Your outsourced financial controllers at VE can perform internal controls such as bank reconciliations to authenticate the integrity of data between the bank records and your business’ internal financial records to detect errors, fraud and missing items.

VE’s virtual financial controllers in India will help you conduct credit card reconciliation to make sure that the transactions in your company’s credit card statement perfectly match its general ledger for efficient and accurate financial reporting.

Hire financial controllers from India to keep your company’s records organized and easily accessible for examination and collaborate with external auditors who can prepare internal company audits to achieve financial reporting compliance.

Highly experienced in Bookkeeping, Taxation with extensive knowledge and understanding of QuickBooks.

A highly motivated and versatile Financial Analyst with good knowledge in Bookkeeping, Accounting, Records Keeping, Budgeting, Forecasting, Variance Analysis, etc.

Proficient in US GAAP and has expertise in Bookkeeping, maintaining financial accounts, and preparation of financial statements.

Kick-start your project straightaway with our popular No-Obligation, No-Payment up to 3-day Free Trial. Continue with the same resource if satisfied.

Our free, quick, bespoke hiring process helps you save on not just expensive local recruitment fees but also lengthy waiting periods to hire just one resource.

Get your own 'remote workplace in India’, do away with pesky issues such as HR, Admin, Payroll, etc., and only pay your remote financial controller’s salary.

As an ISO27001:2013 certified and CMMiL3 assessed company, VE assures its clients of breach-proof data security and confidentiality at all times.

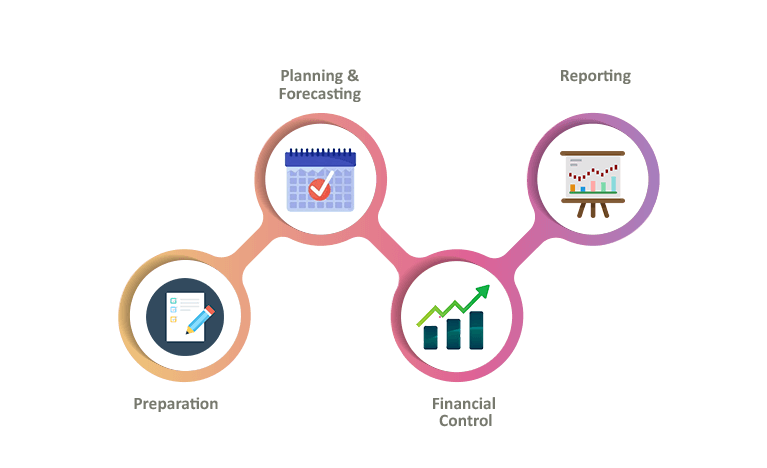

VE’s certified financial controllers engage with the client to secure the financial statements and data to work out an effective financial model.

VE’s remote financial controller then crafts an intensive financial model with the provided financial data and submits the same for the client’s approval.

The virtual financial controller at VE delivers a superior finance management approach through ledger maintenance, budgeting, fixed asset management and more.

To conclude, our offshore financial controllers formulate a comprehensive project report and submit an overview to the client.

It has made me possible to live the kind of life I wanted. I can travel & run my business.

Within a month of starting, he had my QuickBooks all caught up and in a much better state.

She's worked hard and battled through family commitments to deliver the work we needed.

No card details required.

Senior team lead assistance.

Keep all the work. It's yours.

What is one of the most important factors that contributes to the slow-paced growth of an organization...

Read More >

The tedious, monotonously draining nature of accounting work can take its toll on you and lead to oversight...

Read More >

These days, there is a new trend emerging in the offshoring industry in India. Bookkeeping services in India...

Read More >